Table of Content

5 methods to get time period life insurance quotes on this article. With our no-medical exam policies, you could get life insurance with out the difficult means of examination or medical historical past. No blood, no urine, and no doctors that have to verify up with you every here and there.

That’s as a outcome of age and well being are two main components that insurers consider when setting charges. The value of protection will go up annually you wait to purchase life insurance coverage. While some insurers may require you to take a life insurance coverage medical examination, more and more insurers are capable of depend on information modeling to assess danger and permit young, wholesome candidates to get no-exam life insurance coverage. For example, if you're available within the market for term life insurance coverage, you could need to think about an insurer’s age limit to resume the policy or your capability to convert it to a everlasting policy. For example, term life insurance is economical for young families or people who simply bought a house, as they will set the terms of the coverage to match that of their mortgage. This will protect their household and investment ought to they die before the term ends.

Time Period Life Insurance Coverage Quotes

If you wait until you could have critical well being points, you might not be ready to get a traditional life insurance coverage policy as a end result of insurers will consider you too much of a threat to insure. 3 Assumes death benefit has not been paid during preliminary policy term. The Return of Premium benefit on the bottom policy just isn't taxable. Any Waiver of Premium for Disability premiums returned as part of the Return of Premium benefit may be taxable. Get the time period life insurance protection your loved ones want.

Buying sooner means you can lock in a greater price primarily based in your age and well being. Common events that lead folks to buy life insurance coverage are getting married, shopping for a home and having kids. Here’s what you want to know in regards to the fundamentals of life insurance coverage and tips on how to get life insurance coverage quotes.

How Much Are Life Insurance Quotes?

Your life insurance coverage firm finally makes use of your medical historical past and ranking class to determine your term life insurance coverage rates. Every firm charges medical situations in one other way, and purchasing for multiple-term life insurance policy quotes online may help you slim down your prices and higher negotiate with an agent when shopping for a coverage. Permanent life insurance offers lifelong coverage, as long as premiums are paid. It also provides the ability to construct cash worth that grows tax-deferred.

You can save on life insurance by evaluating life insurance coverage quotes and figuring out precisely what policy works in your state of affairs. Term life insurance is essentially the most fundamental and least costly sort of policy you ought to purchase. It supplies protection for a specified interval or “term,” and you ought to purchase a policy for 10, 15, 20, 25, or 30-year phrases. The best life insurance coverage coverage for you will depend in your monetary goals and causes for getting life insurance coverage. So you’ll must assess your monetary state of affairs to determine what you have already got in place to assist loved ones who depend upon you financially and what needs you must cover with life insurance coverage. Here’s tips on how to get life insurance coverage quotes for a plan and protection quantity that matches your wants.

Why Time Period Life Insurance?

Guarantees and protections are topic to Nationwide's claims-paying capability. Life insurance is issued by Nationwide Life Insurance Company, or Nationwide Life and Annuity Insurance Company, Columbus, Ohio. The insurer updated its pricing after you obtained your quote however earlier than you accomplished your utility. Smoking or vaping will lead to a tobacco score class and a significantly higher coverage price.

Term life insurance coverage provides safety for a specific period of time . With low preliminary premiums, it supplies an reasonably priced method to defend your family whenever you want it most. In order to receive a policy, you might want to finish a life insurance medical exam in order that your insurer can get an concept of how healthy you're.

Whole life insurance coverage offers lifelong coverage and a cash value function. A typical younger couple is healthier off purchasing a 12 months time period life policy to hold them over until retirement, when the risk of earnings loss and child-care expenses disappears. If couples accurately use and gage a time period life insurance coverage, they'll save far more over shopping for a everlasting whole life policy. If you've family members that rely in your revenue, and you've got debt and limited financial savings, then term life insurance coverage is a necessity.

Also, if your loved ones has a history of heart problems or hypertension, you presumably can expect to pay more for life insurance. Our life insurance coverage trade partnerships don’t influence our content material. To compare quotes from many alternative life insurance firms please enter your ZIP code above to use the free quote software.

Why Do I Would Like Life Insurance?

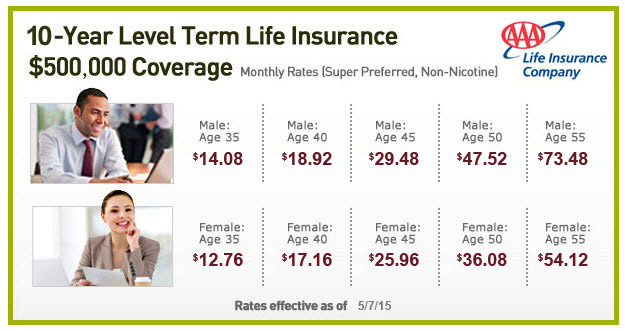

The monthly value for time period life insurance coverage will range based on your specific situation. For instance, the younger you are, sometimes the decrease your premium shall be as you're much less likely to move away before your time period ends. Women also tend to pay less as a outcome of on average they reside longer than males. If you’re not sure how lengthy you want a coverage, you presumably can store for time period life insurance quotes to see which coverage length fits your price range. The finest approach to get inexpensive life insurance is to get a quote when you are younger and wholesome.

It’s necessary to seek the advice of with a monetary planner to search out out whether or not this strategy makes sense for you. The amount of the demise benefit is dependent upon how a lot coverage you choose to purchase. Coverage quantities can vary from the very small (such as $5,000) to cowl funeral expenses to the hundreds of thousands of dollars.

Performance info may have changed for the rationale that time of publication. Consider working with a monetary planner who may help evaluate your situation and figure out what kind of life insurance will slot in your monetary plan. You can discover a fee-only planner through the National Association of Personal Financial Advisors. Or your workplace would possibly offer you access to a monetary professional as part of your benefits.

Therefore, in case you have a 401 or one other retirement plan, you may not want a everlasting life policy, making term life a more inexpensive option. If your insurer doesn’t require a medical exam, it'll mechanically assume you're at greater danger and charge higher life insurance charges accordingly. As you probably can see, term life coverage is dearer the older you are when you apply for a policy.

You make premium payments in the course of the time period you’ve chosen, and your insurer pays a dying benefit to your beneficiaries if you pass away. Sometimes an error or typo can occur when you’re filling out the web application, which can drastically change your life insurance coverage rates. It can be best should you didn’t contemplate any quotes as the ultimate price until you may have your coverage. When requesting quotes, you could be given two choices — term life quotes with a medical examination or time period life quotes with no medical exam.

No comments:

Post a Comment